How to Avoid Losing Money in Thematic Investing

Learn how to stay ahead in thematic investing with strategies to avoid common pitfalls and optimize your investment returns

Narratives drive investment choices, and they often overshadow hard data, as we see in my last article posted on Graham-Quality Investor newsletter. The lure of a good story, such as the technological revolution, can convince investors to pile into ETFs at the peak of a trend. But, by the time the average investor is aware of these megatrends, the market has already priced in much of the growth potential. The story of these ETFs has evolved from one of boundless opportunity to a cautionary tale about the dangers of buying into a trend at the wrong time.

Consider the boom in renewable energy ETFs. In 2020, these funds were hailed as the future, driven by increasing awareness of climate change. But by 2023, many had underperformed the broader market. Investors who entered late, enticed by headlines, found themselves facing a harsh reality. The lesson? Timing matters, and so do fundamentals.

The Risk of Chasing Innovation

A common mistake with thematic ETFs, is treating them as long-term, buy-and-hold investments. They thrive in tactical strategies that take advantage of momentum, trend-following, FOMO or macroeconomic factors. The key is identifying optimal entry and exit points (which can be tricky), as they only deliver explosive returns during market euphoria or high-expectation periods. Beyond that, their performance can be average or even subpar.

While their underlying technologies often disrupt industries, this disruption doesn’t always translate into reliable financial returns. And it may be a revolutionary idea that will change the world and our lives for the best, but it won't automatically yield strong or/and long-term results.

We’ve seen cases in history where world-changing ideas didn’t reward shareholders, due to poor timing or misaligned valuations.

So, if the narrative around the theme is strong —when investors are excited about future potential, think twice and tread carefully.

Not all great ideas and innovations are good investments.

Why Thematic ETFs Don’t Belong in Passive Portfolios

It’s easy to fall into the trap of thinking that thematic ETFs can serve the same role as diversified index funds in a long-term, passive portfolio. After all, if AI or clean energy is the future, why not invest for the next 20 years?

First, the next 20 years consist of many short and medium-term periods that we must survive. If we can’t make it through those, we won’t reach that long-term future.

Second, there is the risk of chasing innovation, as I pointed it out above.

And last but not least: they have a wide dispersion in their returns, which makes them much more unpredictable and volatile compared to broad, well-diversified ETFs or index funds. This means their performance is highly dependent on the timing of the purchase and the market's sentiment. If the entry point is poor, we could face years of returns below par.

Remember, while money can be regained, time cannot. Lost time interrupts compound interest, which is one of the most common reasons why many investors underperform the index. Failing to capitalize on compounding can significantly reduce long-term returns.

For instance, while ARK's funds saw explosive growth during the 2020-2021 tech boom, they quickly stumbled when market conditions changed, leading to significant underperformance. In this context, thematic ETFs are more suited for active management and shorter time frames, where investors can time their entry and exit points to capitalize on phases of euphoria rather than simply holding through the volatility. Assuming you have a proven and robust strategy.

If you're looking for positive optionality, meaning the potential for high returns with greater uncertainty, risk, and volatility, you can consider betting on thematic ETFs or others, but keep them separate from your passive index portfolios. Together but not mixed. To avoid picking the worst ones or those with a higher chance of loss, here are some filters to help guide your selection.

Thematic ETFs are more suited for active management and shorter time frames.

How to Avoid Losing Money in Thematics ETFs

Ok, let me be honest: There is no way to guarantee that money won't be lost when investing in ETFs, especially thematic ones, but we can use some mental models as filters so we may be able to reduce the probability of fail.

Inversion: Start by Asking What Could Go Wrong. Instead of asking, “How will this ETF succeed?” ask, “How might this ETF fail?”. This is the essence of inversion that Saint Munger tried to teach us, a powerful mental model that helps investors avoid cognitive traps. For example, AI ETFs could underperform if the market becomes saturated with competition and supply, if investors have rosy expectations, if valuations get too high, or if the companies within the ETFs struggle to grow earnings.

Probabilistic Thinking: Investing is a game of probabilities, not certainties, and thematic ETFs are inherently speculative, so applying probabilistic thinking is critical. Rather than betting on certainties, assess the probabilities of various outcomes the hype around disruptive technologies can create an illusion of inevitable success. What are the chances that these technologies will continue to thrive, and more importantly, when do the companies held within the ETF will generate positive returns? The next mental model can be helpful.

TAM, SAM, and SOM

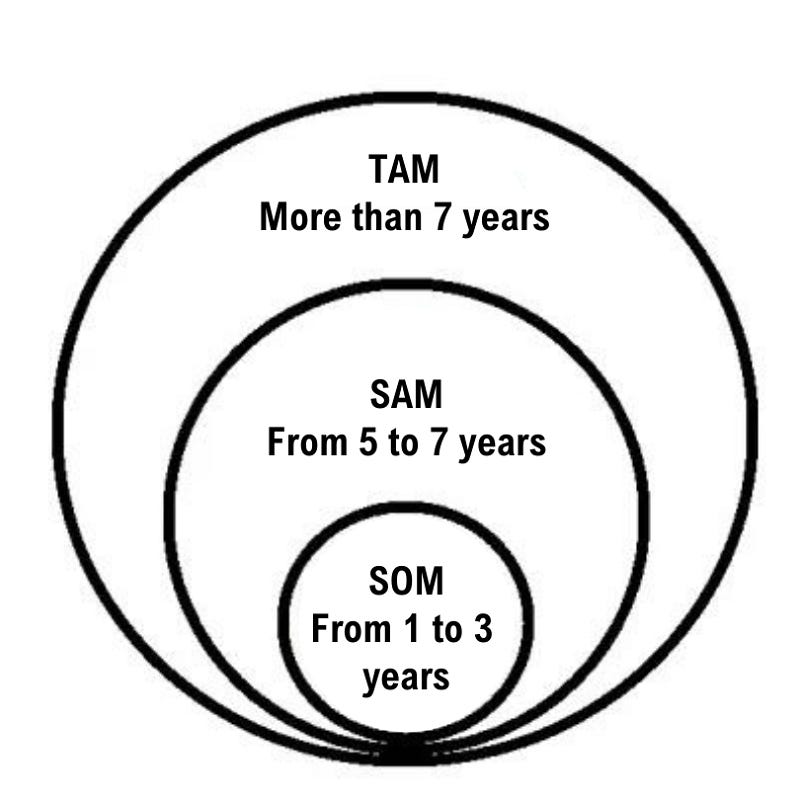

TAM, SAM, SOM model is a tool used in market analysis to help investors and companies understand the size of an opportunity and when will the benefits materialize. Here it is how can we use it.

First avoid double counting. This refers to not assuming that one company will capture the entire TAM or SAM, as this is rarely the case. Customers are typically split among various competitors, and market fragmentation and margins depend on the microeconomics of each industry. For example, it was a mistake to think that Virgin Galactic will capture all spaceflight customers. If I’m adding customers for one company while also considering those my competitors could capture, I’m double counting. This is the most common error and leads to inflated valuations. Uber made a similar mistake, assuming it would dominate the entire market.

Second, When Will Those Benefits Materialize? This internal tangent circle model with timeframes is helpful because it allows us to visualize roughly when tangible benefits from growth investments might appear. Many errors that inflate valuations and raise expectations occur here. Investors often expect profits from the potential TAM to arrive in the short or medium term, inflating stock prices. But when one to three years pass and profits don’t materialize, disappointment sets in, and the stock dives. To keep our valuations and forecasts realistic, we must understand when profits might actually arrive and discount them accordingly. A common illusion is expecting profits from 7 to 10 years in the future to arrive by the end of this year.

Survivorship Bias

Survivorship Bias occurs when we focus only on successful innovations while ignoring the majority that failed. This bias leads to misleading conclusions about a technology’s potential. By considering both winners and losers, we can make better, more informed decisions.

Don’t get carried away by the winners, as they are the few and exceptions. Instead, look at everyone—both the winners and the losers. Evaluate the ETF based on the entire portfolio, not just the standouts. And analyze, using base rates, all the innovations that didn't give great investment returns.

Look at everyone—both the winners and the losers. Evaluate the ETF based on the entire portfolio, not just the standouts.

If you review the list of delisted and liquidated ETFs, you’ll notice the large number of ‘failures.’ This helps us avoid falling into the survivorship bias, as it provides a clearer picture of how many ETFs don’t survive and why it's essential to consider both winners and losers.

This approach helps investors visualize the overlap between potential, serviceability, and realistic outcomes, preventing the trap of overly rosy expectations.

Conclusion

Thematic investing offers exciting opportunities to capitalize on emerging trends, but it also comes with significant risks. As we've explored, the allure of a compelling narrative can lead investors into overvalued markets, where the potential for returns may be limited. The key to success in thematic investing lies in a disciplined approach: understanding the underlying fundamentals, being aware of timing, and using mental models like inversion and probabilistic thinking to avoid common pitfalls.

Remember, thematic ETFs are not a one-size-fits-all solution. They should be approached with a tactical mindset, ideally as part of an actively managed portfolio rather than a passive one. By applying rigorous analysis and maintaining a healthy skepticism, you can better position yourself to take advantage of the opportunities thematic investing presents while minimizing the risks of chasing trends.